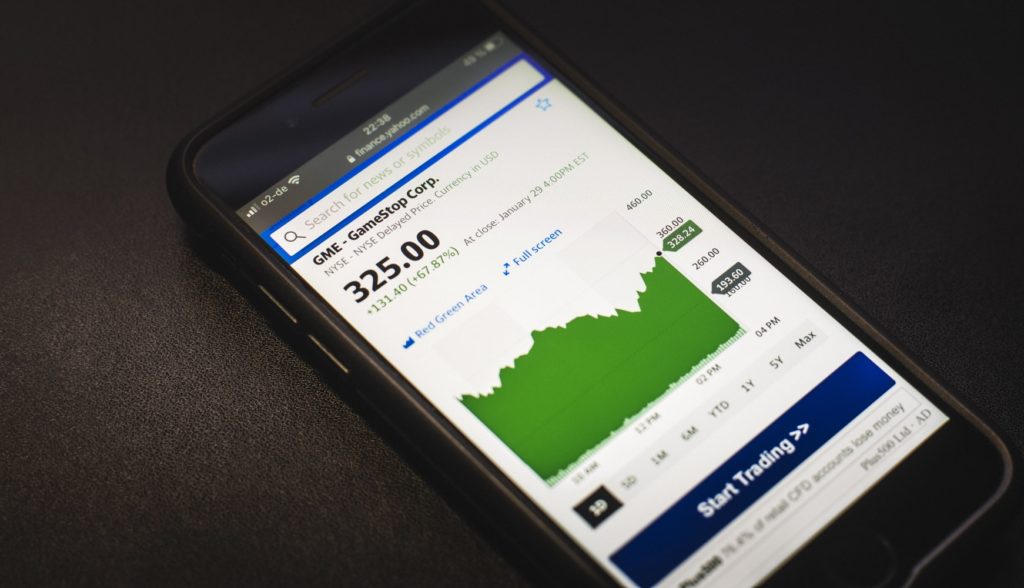

The frenzied Gamestop mess may have significantly cooled off as the industry awaits impending SEC regulation, but that doesn’t mean life has returned to normal.

Shots fired

After years of being looked down upon as “dumb” money by the big firms, the little guys certainly got their attention with their whiplash inducing Gamestop shenanigans. Retail investors proved to themselves, and the big firms, that they are a force to be reckoned with and should be taken seriously. Especially if the ‘rebellion’ becomes highly organized and sets up to play the long game—Gamestop would have been a warning shot.

Like all proletariat revolutions, once the masses realize they can potentially outmaneuver the elite—either by wit, sheer size or both—it’s game on! The little guys have proven that social collusion works—there’s no doubt that this hive mentality will likely continue. This genie won’t go back into the lamp, and why would it? There’s no incentive to play fairly in a system that’s exposed itself as a meat grinder for the little guys.

Portfolio management

Savvy big money shops were already monitoring online message boards, but now it’s standard practice, thanks to Gamestop. Many folks were caught off-guard by the real world social collusion that emerged from the digital world, and have since been forced to recalibrate their existing portfolio management strategies.

Of course, online message boards know this, and will likely be driven deeper underground and embrace dark social as a result.

Nothing succeeds like success

Now that retail investors have flexed their power to move markets, let’s see them do it for real. With regulators likely to hand down regulation that pushes the little guy even further away from the folding money on Wall Street, we find ourselves at a crossroads. Retail investors could continue their assault on Wall Street—which is akin to pissing in the ocean—or they could get strategic and expand their sights to include another Federally regulated ecosystem: equity crowdfunding. This way they can flank the enemy.

Think about it.

We can all agree that money is the only thing that truly grabs Wall Street’s attention, right? And by money, we mean profits. So why wouldn’t it make sense to just run more Gamestop type attacks? Because the cost of regulation is factored into those profits and someone is always paying for expensive lobbyists to slant regulation in their favor. Given that at present, the rebellion’s reach doesn’t extend that far, then it could make sense for retail investors to instead shift their buying power into an ecosystem that seems to offer tangible value and economic positioning: equity crowdfunding. Supporting and bolstering small businesses, local communities and the 99%, particularly when that support possibly results in billions of dollars of potential exits occuring for the so-called ‘dumb’ money, is a strong and effective way to flip off VCs and Wall Street elites in one swoop. While equity crowdfunding may not yet be as glamorous as Wall Street, it’s incredibly practical at getting money into everyday people’s pockets and possibly shifting the paradigm of wealth.

Wanna be the Joker or Batman?

Misfit investors channeling the Joker’s nihilistic desire to watch the world burn, may have an opportunity to flip this dystopian script into Marvel superhero mode. By pointing their firehose of social collusion at meaningful causes—like funding the shit out of local communities and a diverse group of entrepreneurs via equity crowdfunding—they can stick it to ‘the man’ and right some of the lingering wrongs from the 2008 recession.

2020 Proved To Be An Inflection Point for Crowdfunding