The JOBS Act was designed to offer companies of all sizes easier access to capital through Regulation crowdfunding (“Reg. CF”). Reg. CF allows private companies to sell securities such as equity, debt, membership units and convertible notes, directly to everyday investors. Prior to Regulation A+ of the JOBS Act, only accredited investors could provide startup capital, severely limiting investment opportunities for everyday people.

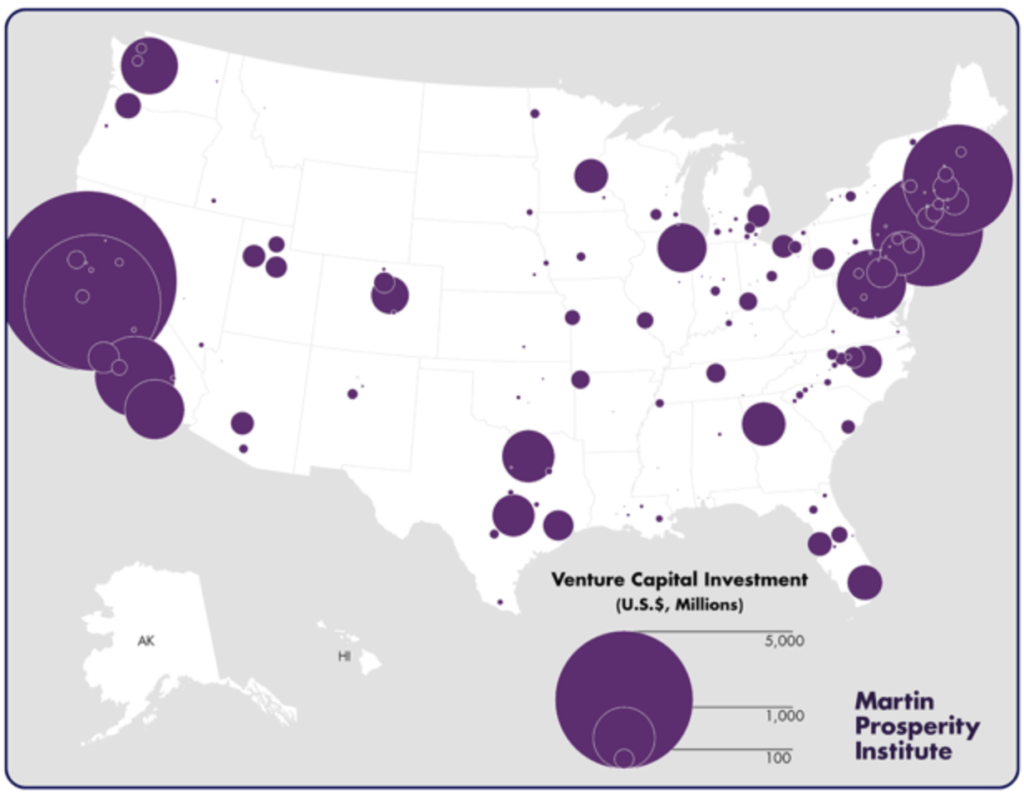

Venture capitalists have a long history of investing in technology, which makes sense as to why they cluster in the most innovative, high-tech cities in America. However, this concentration of angels and venture capitalists along the coast, tends to leave the rest of America underfunded.

Reg. CF has removed VCs from their long-held roles as gatekeepers. As a result, more entrepreneurs now have access to capital, and investors now have new exposure to early startup investment opportunities. Entrepreneurs and small businesses are free from VC and angels, allowing them to sell equity directly to their fanbase, users and clients, generating an evangelical following that understands the value of their product or service offering. Everyday consumers now get new access to potentially life-changing investments that were previously never an option.

Boasting lower costs and greater liquidity, regulation crowdfunding allows more startups and entrepreneurs to receive funding; subsequently encouraging more investor participation – leading to a stronger US economy.

Regulation crowdfunding disrupts the old model of venture capitalism, because there’s no requirement for companies to achieve 100X growth in order to cover their other losses. As such, VCs are now forced to re-strategize their investments and consider shorter term agreements.

Non-accredited investors participating in regulation crowdfunding gives entrepreneurs another avenue to raise money, beyond venture capitalists and angels, opening the door to more opportunity for all.